For firms that manage digital assets, building an industry-leading performance record requires strong risk controls. That’s why the top risk teams in crypto have already integrated Agio Ratings into their risk analysis and monitoring. Agio Ratings provides advanced modelling, anomaly alerts, and continuous risk monitoring to help firms manage crypto risk intelligently.

However, we appreciate that getting internal buy-in to implement new solutions can be challenging. Fortunately, you can prepare yourself ahead of time with information to lead your team toward a more sophisticated approach to managing risk. Our guide shares how to secure executive buy-in.

In this guide, we’ll address:

- Why you need to model crypto risk accurately

- The drawbacks of current approaches

- The cost of inaction

- Key criteria for choosing the right solution

Step 1: Illustrate why your firm needs to model crypto risk accurately

Even after FTX, a startling number of firms continue to rely primarily on Twitter, Telegram, and proof of reserves to monitor risk signals. We understand why. Few teams are equipped to collect all the data required to measure counterparty risk quantitatively. What data is collected might weed out the truly poor risks, but it still leaves PMs vulnerable to counterparties that are weaker than they look.

With Agio Ratings’ default risk ratings, firms can calibrate exposure based on a quantitative measure of risk. Our data is independently sourced and rigorously tested to ensure that our ratings incorporate only statistically significant risk factors.

Here’s how this benefits you:

- Protect capital: risk ratings like Agio’s allow you to set risk-adjusted hurdle rates, enforce trading limits and policies, and monitor exposure at default and losses given default.

- Enhance lending practices: with specialized ratings, you can price credit with precision and generate a sustainable and defensible return on your loan portfolio.

- Set the stage for successful fundraising: showing your LPs that you’re willing to invest in a reputable risk management system sets your firm apart from the competition.

- Impress regulators: By proactively managing risk, you demonstrate a culture of compliance and show regulators that you take your responsibilities seriously.

Step 2: Demonstrate the drawbacks of current crypto risk management practices

In some cases, team members may be hesitant to adopt a new solution that replaces an approach they’ve worked with for years. It’s important to note that change doesn’t need to be revolutionary to be effective. Being incrementally better at managing risk can translate into outsize returns.

One incremental change is diversification. Some PMs overreact to the lack of quantitative risk measures by concentrating exposure with a small number of counterparties they think they trust. This approach may leave a lot of money on the table by unnecessarily avoiding counterparties who can bring new and better opportunities to a fund manager. More counterparties also means greater diversification, which can be a risk mitigator.

Another modest change can be balancing between direct and indirect exposures. Many firms rely on custodians to help manage their exposure to exchange risk. However, this approach always leaves users exposed to position replication risk – the risk that rebuilding investment positions after a counterparty fails can end up quite costly. Evolving your strategy to include a greater number of direct exchange exposure may reduce costs while improving total returns.

Step 3: Show how the crypto risk solution will impact the bottom line

Even if the whole team agrees that implementing a solution like Agio Ratings is the right decision, there’s still the matter of cost. Demonstrating how the system you have selected will provide an upside will help you remove any final barriers to adoption.

Typical upside benefits include:

- Reduced counterparty credit losses by better identifying and mitigating default risks

- Lower capital requirements and reserve needs by more accurately pricing risk

- Increased revenue opportunities from being able to safely underwrite larger credit exposures

- Operational cost savings from automated risk monitoring and analysis

- Competitive advantage from enhanced risk management capabilities attracting new institutional clients

- Improved regulatory standing by demonstrating robust risk controls

- Avoidance of massive losses from being able to detect risks early like with FTX

Essentially, Agio Ratings helps drive tangible bottom-line results by precisely quantifying counterparty credit risks. Our sophisticated data-driven models and ratings enable clients to reduce unexpected losses from defaults, optimize capital deployments by right-sizing risk buffers, and capture new revenue streams by safely increasing credit exposures.

Step 4: Highlight the risks of inaction

If demonstrating the upside impact isn’t a strong enough argument, presenting the risks of doing nothing may help to build your business case for crypto risk solutions.

If firms rely on inadequate risk controls, here’s what can happen:

❌ Financial losses: Volatile market swings, liquidity shocks, and disruptive regulatory changes—all par for the course in crypto—can translate into devastating losses when risks aren't properly identified and mitigated. Inadequate safeguards allow manageable threats to spiral out of control.

❌ Reduced capacity for leverage: Firms that fail to demonstrate risk controls will find their leverage and access to credit reduced, as counterparties view them as excessively risky. This can limit the firm's ability to scale operations or capitalize on market opportunities.

❌ Missed opportunities: Hesitation equals missed profits. Firms may want more exposure to crypto but they don’t have the capabilities to assess risk. As a result, they will continue to see more agile players capitalize on windows of opportunity. Lacking advanced analytics to rapidly model risks means always being a step behind.

❌ Erosion of trust: Perhaps most crucially, weak risk management practices erode trust among investors, partners, and regulators. As losses mount and strategies falter, investors flee, partners become skittish, and regulators apply extra scrutiny. This loss of faith can create a downward spiral from which recovery is extremely difficult.

Once you have taken stakeholders through the above steps, they may rightly question the criteria for choosing a disciplined, structured approach to crypto risk. To help with this, our next section will take you through the key criteria you need from a solution.👇

Choosing the right crypto risk management solution

The right solution will speak for itself through the different features, advantages, and benefits it provides. Here’s a checklist of essential features that allow firms to benefit from better risk management, and alleviate stakeholder concerns. We’ll use Agio Ratings features to articulate what good looks like.

⬜ Quantitative view of risk

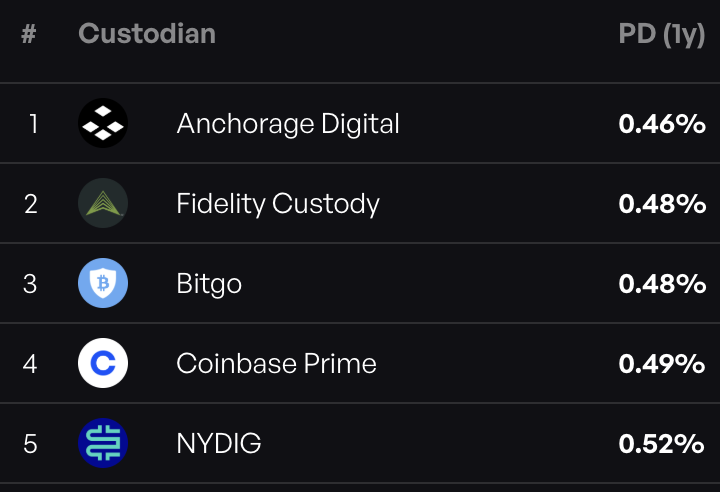

Does the solution leverage TradFi-tested models like Altman’s z-score to produce probabilities of default that accurately capture risk?

⬜ Track record of successful ratings

Can the solution provider showcase strong performance metrics? In the summer of 2022, Agio Ratings rated FTX as a poor risk. This went against the market consensus. Critics of our assessment cited the strong tech team (with their deft handling of the Merge), the superb customer service and the substantial equity valuation established by FTX’s VC backers. We cited a sound analysis of statistically significant risk factors.

⬜ Used by the top risk teams in crypto

Are the teams that use the solution provider best-in-class. Agio Ratings’ clients manage hundreds of millions and hold permissions and licenses from the most respected financial regulators around the globe. They use our solution because they understand the value of leveraging data that has been rigorously back-tested and refined over the years.

Secure internal buy-in and choose the right crypto risk management solution

The crypto ecosystem shows no signs of slowing. Market swings, regulatory shifts, and ever-present risks remain constant challenges. However, there are immense opportunities for firms equipped with the right tools.

With Agio's advanced risk analytics, firms gain the trusted insights to make highly informed decisions that maximize profitability while safeguarding their business.

If improving your risk management approach is a priority we’d love to talk about how Agio Ratings solutions can benefit your firm, book a demo and talk to one of our experts.