One of the first Agio blogs was about the apparent phase change in drivers of default over the past few years. Prior to 2020, centralised exchanges tended to default because they were either hacked or turned out to be frauds. Mt Gox is the poster child of this era. But over the past few years, defaults have been increasingly caused by commercial misjudgments and poor risk management.This is a more recognisably TradFi pattern. For example, firms have failed because they were over-exposed to currencies (e.g. Celsius), regulatory uncertainty (e.g. Bittrex) or defaulting counterparties (e.g. Voyager). This means that the exchanges and the market makers trading digital assets now need more recognisably TradFi risk management, including counterparty probabilities of default.The following chart shows the updated timeseries for 2023. Last year’s data continue to demonstrate the same TradFi default causes. It also quantifies just how extreme trading conditions were in 2022. The number of larger defaults -- 24 firms -- was 2.9x the average of the prior three years. For comparison, the last US corporate bankruptcy peak was in 1Q 2010, after the Great Financial Crisis, and weighed in at 1.7x the average.

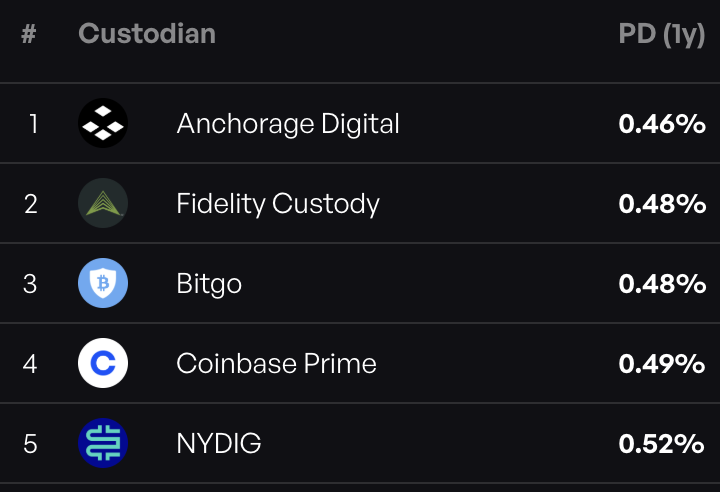

So, given this data, what is the base-rate 1-year probability of default for a centralised exchange? Of the 70 larger firms rated by Agio in July 2022, about 20% had defaulted--defined by halting withdrawals--by January 2024. Given that this is an 18 month interval, the annualised default rate is 14%.Prospectively, there are a couple of adjustments you could make. First, this base rate is for 70 exchanges. The main exchanges in this report are larger and therefore about 0.5x safer. Hence their base rate is nearer 7%, in line with the 8% shown on page 5. Second, 2022 was an extreme year. The cycle-neutral base rate might be 0.5x the past 18 months. The 8% on page 5 might be closer to 4% in the long run.These are still big numbers in a TradFi context. For example, the observed 40 year annual default rate of S&P’s B rating is 5.6%. Conversely, Bank of America is rate A- (observed default rate 0.07%) and Fifth Third Bank is BBB+ (0.12%). Accordingly, depositing funds with these banks for a year yields 0.6% and 1.2% over US Treasuries. Depending on the allocator, a 4% counterparty risk might be worth taking, if the potential return justifies it.